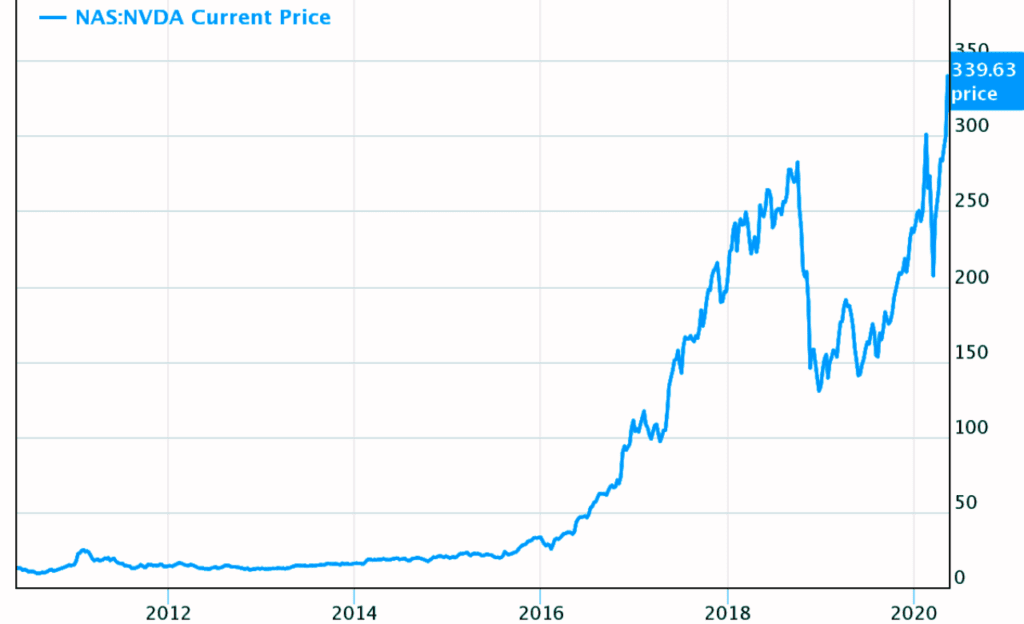

Nvidia Corporation (NVDA 1.20%) has been making waves in the financial world with its remarkable performance. Just three months ago, the company provided guidance that turned heads across the industry. The graphics processing unit (GPU) manufacturer projected its second-quarter revenue to be around $11 billion. Anticipation ran high as Nvidia reported its Q2 results after the market closed on Wednesday, and it certainly did not disappoint. The stock experienced a significant surge in after-hours trading following yet another impressive earnings report. This article delves into the astonishing figures and explores the potential heights that this all-star stock can achieve.

Table of Contents

Behind the Blowout

Nvidia’s management had initially projected second-quarter revenue in the ballpark of $11 billion. However, the reality exceeded expectations by a substantial margin. The company’s Q2 revenue reached an astounding $13.5 billion, more than doubling the revenue generated in the previous year. This exceptional performance highlights Nvidia’s strong market presence and innovative strategies.

Soaring Data Center Revenue

One of the most striking aspects of Nvidia’s Q2 performance was its data center revenue. This revenue segment experienced an incredible sequential growth of 141% and a year-over-year increase of 171%, culminating in $10.3 billion. This surge underscores the growing demand for Nvidia’s solutions in the data center domain.

Impressive Gaming Revenue

Nvidia’s gaming division also saw remarkable growth, with a year-over-year revenue increase of 22%, reaching nearly $2.5 billion. This success can be attributed to the company’s ability to capture the gaming market’s evolving needs, making its products highly sought after by gamers worldwide.

Positive Trends in Automotive and More

Even in other segments, Nvidia exhibited impressive growth. The automotive revenue rose by 15% year over year, reaching $253 million. This growth indicates the company’s successful ventures in powering next-gen vehicles with cutting-edge technology. However, there was a slight downturn in the professional visualization sector, where sales fell by 24% year over year to $379 million. Despite this dip, the figure marked a 28% increase from the previous quarter, suggesting a potential rebound.

Soaring Profits

Nvidia’s remarkable revenue figures were mirrored in its profits. The company generated earnings of nearly $6.2 billion in the second quarter, an astonishing threefold increase from Q1. This surge reflects Nvidia’s efficient operational strategies and its position as a leader in the tech industry.

‘The Race Is On

Founder and CEO Jensen Huang’s statement, “A new computing era has begun,” carries significant weight. Nvidia has been at the forefront of technological advancement, with companies globally transitioning from general-purpose computing to generative artificial intelligence (AI) and accelerated computing. Huang’s declaration that “the race is on to adopt generative AI” underscores Nvidia’s leading role in this transformative period.

Positive Revenue Momentum

Nvidia’s upward trajectory shows no signs of slowing down. The company anticipates its third-quarter revenue to reach approximately $16 billion. This estimate stands 27% higher than the consensus Wall Street prediction preceding Nvidia’s Q2 update. Even the most optimistic estimate among the 33 analysts surveyed by Refinitiv, which was around $15.2 billion, was surpassed by Nvidia’s projection.

Continued Innovation

Nvidia is not content to rest on its laurels. The company has announced a range of new products set to roll out in Q3 or the near future. These include the L4OS GPU, designed for AI servers, and Spectrum-X, a technology aimed at enhancing AI cloud performance. The GH200 Grace Hopper Superchip, already shipping in Q2, is tailored for complex AI and high-performance computing workloads. Nvidia plans to launch a second-generation version of this chip in the second quarter of 2024.

How High Can Nvidia Fly? Exploring the Growth Potential

Nvidia, a global technology giant renowned for its cutting-edge graphics processing units (GPUs) and artificial intelligence (AI) solutions, has been making waves in the stock market. With its recent Q2 update, Nvidia demonstrated remarkable results that left Wall Street analysts and investors buzzing. In this article, we’ll dissect the factors contributing to Nvidia’s potential ascent and explore the challenges it faces on its journey to greater heights.

How High Can Nvidia Fly Before Q2 Update?

Before Nvidia’s Q2 update, Wall Street’s consensus 12-month price target for the stock hinted at a potential upside of slightly over 11%. However, Nvidia’s share price nearly reached this target in after-hours trading following the update. The company’s impressive Q2 results and optimistic outlook are expected to prompt analysts to revise their targets upward. The most optimistic analyst projection, prior to the Q2 earnings report, suggested that Nvidia’s stock could surge by almost 70% in the next 12 months. This bullish target is feasible if the chipmaker’s revenue continues its current growth trajectory.

The Perfect Storm: Surging Demand and Limited Supply

Nvidia currently finds itself in an ideal scenario—surging demand for its AI chips combined with limited supply. This alignment of factors is often referred to as a “perfect storm.” The heightened interest in AI applications across various industries has propelled Nvidia’s products into the spotlight. However, it’s essential to recognize that this favorable situation may not last indefinitely.

Facing Competing Giants

While Nvidia holds a dominant position in the market, several tech giants including Advanced Micro Devices, Amazon, Microsoft, and Alphabet are actively developing their AI training and inference chips. Although Nvidia is likely to maintain its market leadership, these competitors’ efforts could disrupt the current dynamics that have been driving its momentum.

The Valuation Conundrum

Nvidia’s impressive growth has driven its valuation to new heights. Even before the Q2 update, the stock was trading at 19 times the projected 2025 sales. This poses a challenge—much of Nvidia’s growth potential might already be factored into its current price. At the extreme, its stock may be trading well above its realistic growth prospects, casting doubts on its future potential.

Aiming Higher: The Path to Growth

For Nvidia to soar higher, it must continue delivering revenue growth that exceeds expectations. Achieving this is easier said than done, especially given the competitive landscape and the need to meet heightened market expectations. The company’s ability to innovate, expand its product offerings, and adapt to evolving industry trends will play a pivotal role in determining its growth trajectory.

Exploring Alternatives: The Motley Fool’s Perspective

Before jumping aboard the Nvidia train, it’s worth considering alternative investment options. The Motley Fool Stock Advisor analyst team recently unveiled their selection of the 10 best stocks for investors to buy right now, and Nvidia didn’t make the cut. Stock Advisor, an online investing service with an impressive track record, has outperformed the stock market by threefold since 2002. According to their insights, there are 10 stocks that offer better potential returns than Nvidia.

Conclusion

Nvidia’s stock surge after another blowout earnings report reflects its exceptional financial performance. The company’s revenue and profit figures have exceeded expectations, showcasing its dominance in the tech industry. Nvidia’s commitment to innovation and its role in ushering in a new computing era highlight its potential for continued growth. As the company continues to expand its product offerings and capitalize on emerging technologies, the question remains: Just how high can this all-star stock fly?

Nvidia’s journey to greater heights is undoubtedly filled with opportunities and challenges. Its impressive Q2 results and optimistic outlook have generated excitement, but the company must navigate through competition, valuation concerns, and the need to meet and exceed market expectations. As investors evaluate Nvidia’s potential, considering alternative investment options like those recommended by The Motley Fool can provide valuable insights into optimizing their investment portfolios.

FAQ’s

Q: Can Nvidia’s stock reach a 70% increase in the next year?

A: The most optimistic analyst projection suggests that Nvidia’s stock could potentially surge by almost 70% over the next 12 months if the company’s revenue growth trajectory remains on track.

Q: Is Nvidia facing competition from other tech giants?

A: Yes, several major companies including Advanced Micro Devices, Amazon, Microsoft, and Alphabet are actively developing their AI chips, posing competition to Nvidia’s market dominance.

Q: What challenges does Nvidia’s valuation pose?

A: Nvidia’s stock is trading at a high valuation, with its growth potential potentially already priced in. This valuation challenge raises questions about the stock’s future growth potential.

Q: How important is Nvidia’s ability to deliver revenue growth?

A: Nvidia’s ability to consistently deliver revenue growth above expectations is crucial for the company to continue its upward trajectory in the stock market.

Q: Why did Nvidia not make it onto The Motley Fool’s list of top stocks?

A: The Motley Fool Stock Advisor analyst team believes that there are 10 other stocks with better potential returns than Nvidia at the moment.

Q: What is Stock Advisor’s track record in beating the stock market?

A: Stock Advisor, an online investing service, has consistently outperformed the stock market by threefold since the year 2002.

Q: What was Nvidia’s second-quarter revenue projection?

A: Nvidia projected its second-quarter revenue to be around $11 billion.

Q: How much did Nvidia’s Q2 revenue actually reach?

A: Nvidia’s Q2 revenue exceeded expectations, reaching an impressive $13.5 billion.

Q: What contributed to Nvidia’s substantial revenue growth in the data center segment?

A: Nvidia’s data center revenue experienced remarkable growth due to a sequential increase of 141% and a year-over-year rise of 171%, totaling $10.3 billion.

Q: What was the year-over-year growth in Nvidia’s gaming revenue?

A: Nvidia’s gaming revenue witnessed a 22% year-over-year increase, reaching nearly $2.5 billion.

Q: Which revenue segment saw a 15% year-over-year increase in Q2?

A: Nvidia’s automotive revenue grew by 15% year over year, totaling $253 million.

Q: What was the notable growth figure in the professional visualization sector?

A: Despite a 24% year-over-year decrease, the professional visualization sector experienced a 28% increase from the previous quarter.

============================================