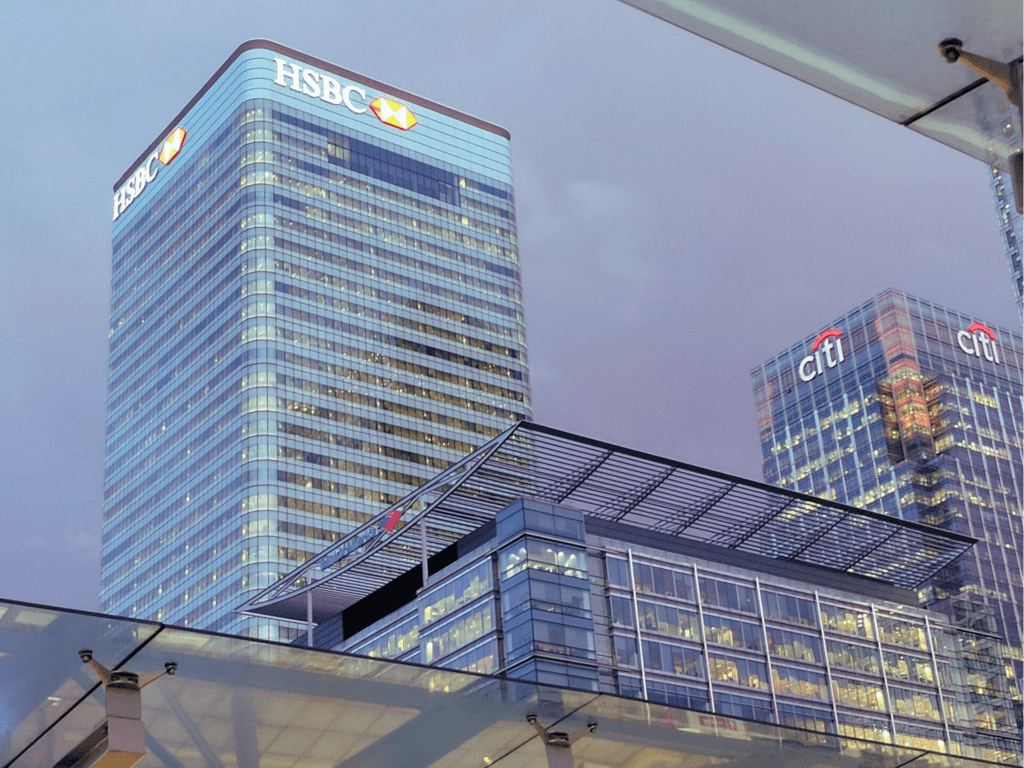

The first half of the year’s net profit for HSBC was $18.1 billion in June, more than tripling from the same period last year when it was $9 billion.

The bank’s earnings before taxes increased by 147% year over year to $21.7 billion from $8.78 billion in the first half of 2022.

When asked about the potential timeline for the bank’s profitability to reach pre-pandemic levels, CEO Noel Quinn responded, “If everything goes according to plan this year, we should be above our pre-pandemic profit levels.”

Table of Contents

In 2018 and 2019, HSBC paid total dividends of $0.51 and $0.30, respectively.

Two interim dividends of $0.10 each have already been declared by the bank for 2022, bringing the total dividends paid to $0.20. In the words of Quinn, “At the end of the year, we should have the remaining amount to bring our interim dividend to a 50% payout ratio.”

The largest bank in Europe by assets, HSBC, acquired SVB UK in March for £1 ($1.21) in a deal that excluded the assets and liabilities of the parent firm.

Because of higher net interest income from all of its international businesses as a result of an increase in interest rates, revenue for the first half of the year grew by 50% year over year to $36.9 billion.

The first half’s net interest income of $18.3 billion was 36% more than the same period last year, and the net interest margin rose by 46 basis points to 1.70%.

Quinn credited significant sales growth across all business and product sectors for this impressive performance. Without a doubt, one of its components is the interest rate environment. But our fee income and commercial income have also grown well in a strong second quarter.

HSBC reported a pre-tax profit gain of 89% for the second standalone quarter, beating experts’ predictions.

The pre-tax earnings for the quarter that ended in June was $8.77 billion, exceeding the $7.96 billion forecast.

The quarter’s net profit was $6.64 billion, 27% more than the $6.35 billion consensus expectation of analysts and higher than the same time previous year.

In comparison to the same period last year, when total sales were $12.1 billion, the second quarter’s total revenue came to $16.71 billion, a 38% increase.

The shares of HSBC that are listed in Hong Kong increased 1.23% after the announcement.

Additional important details from the bank’s financial report are as follows:

The second quarter’s net interest income increased from $6.9 billion to $9.3 billion, compared to the same period last year.

In the second quarter of 2023, net interest margin, a metric of lending profitability, grew by 43 basis points to 1.72%.

With an eye toward the future, HSBC has raised its medium-term return on tangible equity target from its prior target of 9.9% for 2023 to at least 12%. A “mid-teen” return on tangible equity for the following two years has also been predicted.

According to CEO Quinn, HSBC anticipates growth in corporate banking as well as global wealth and private banking for affluent clients in the future.

“We are investing in areas that will support growth despite the low-interest of interest rates at present. It’s my responsibility to diversify the revenue. And I believe we’re starting to show that, and we’ll keep making investments in revenue diversification.

In comparison to the same period last year, HSBC’s pre-tax profit for the first half of this year was $21.7 billion, exceeding analysts’ average pre-tax profit expectation of $20.9 billion. With a market value of $162 billion, HSBC is the largest bank in Europe.

A London-based bank declares an interim dividend amid a market upswing

The London-based bank has unexpectedly announced that it will pay a 10-cent interim dividend per share. Before 0625 GMT, the bank’s shares soared to HK$66.70 ($8.55), reaching the highest level since May 2019.

The bank’s shares impressively increased by 2% during the London trading session in contrast to the stable FTSE 100 benchmark index.

A mortgage lender named Nationwide reported a major reduction in British home prices in July of 3.8% on an annual basis, the biggest drop since July 2009.

The bank reported a larger credit loss of $1.3 billion in the first half of the year compared to $1.1 billion in the same period last year. This increase may be largely attributable to the bank’s exposure to the commercial real estate market in China and its relationships with UK commercial banks.

As reported by Reuters in May, HSBC is trying to consolidate its global operations to increase profitability while considering quitting a dozen nations.

After merging with competitor bank Sohar International Bank the previous year, the bank also said on Tuesday that it has sold off its interests in Oman.

HSBC announced intentions to leave Russia and sold its retail businesses in Canada, France, and Greece. It also shut down its personal banking operations in New Zealand.

However, the bank conceded that not all asset sales had gone as planned. According to CEO Quinn, the sale of the bank’s Russian company has not yet been finalized since it is awaiting the final regulatory permission, over which they do not have complete authority.

In spite of China’s economic slowdown and continued market hurdles, the bank last Friday obtained its first foreign company fund distribution license in the country.

Quinn noted that the bank has “definitely made its mark” in the Chinese financial industry with its long-term investments, aiming to cover both the established high-net-worth individuals and the newly affluent local residents.

(1 Hong Kong Dollar = 7.7969)

HSBC’s declaration of an interim dividend and its astounding profit increase are unquestionably good news for the firm. It is aware of the market’s warning signs, though, and it continues to be wary of impending difficulties, particularly for its clients who are dealing with economic uncertainty. The bank seeks to weather the storm and continue serving its clients while keeping an eye on attractive opportunities in China’s financial landscape as it considers its worldwide presence and makes strategic decisions.

Humorous Insertion: The bank looks to be getting ready for a roller-coaster ride as it sets out on its quest to combat market instability. Hope they’re wearing their seatbelts and keep in mind that banking isn’t always about the numbers; sometimes it’s about managing risks while maintaining a sense of fun!

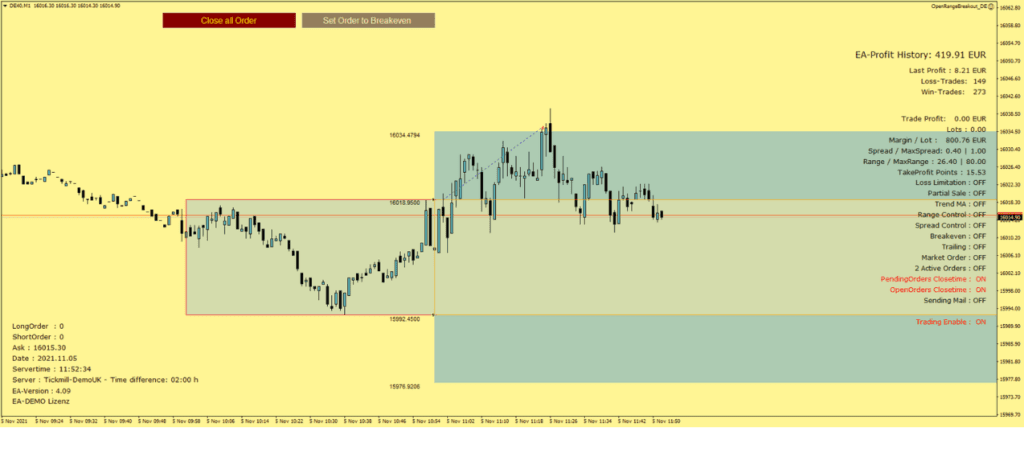

Fully automatic system for breakout trading

The Open Range Breakout Strategy became popular in the 1980s. The book “Day Trading With Short Term Price Patterns and Opening Range Breakout “of the trader Toby Crabel is probably the best known about this strategy.

It is a fairly straightforward approach to trading that is popular with both professionals and beginners. In the pre-market opening phase, one or more stop entries are placed in the market. These will then traded on the market opening breakout.

With the ORB Expert Advisor we have programmed a fully automatic system for DAX CFD trading. This EA uses MetaTrader 4 as a platform. On the website of Youtube are some videos about the EA already published. Automated trading with the MT5 platform will be available shortly.