Are the markets headed for fresh all-time highs? Although it would seem contradictory, the S&P 500 tea leaves are really pointing in that direction, according to J.P. Morgan secret weapon in the American market, Andrew Taylor.

Table of Contents

Taylor asserts that despite the current concerns, the S&P index is still within 5% of its all-time high and that the Fed might support further growth and a shift toward A-rated shares with a slower pace of monetary tightening. Recent earnings reports have already reduced expectations, which creates the ideal environment for a considerable acceleration of market momentum and growth.

Taylor also emphasizes that traditionally, market downturns occur in August and September. He views these price drops as purchasing opportunities, nevertheless, which could lead to gains throughout the fall and strengthen your investments.

Taylor said, “a reboot that shows a subdued trend in unstable data.” “It seems like money is waiting on the sidelines, anticipating opportunities in American shares… touching the 5,000 mark for the S&P should not be surprising, particularly if it is driven more by macro data/economic cycles than by higher interest rates,” he added.

The stock experts at J.P. Morgan are looking at inexpensive equities with a high potential for future gains in line with this viewpoint. These are stocks with a share price under $10 that could increase in value by doubling during the next 12 months.

And it’s not only J.P. Morgan who supports these names. Using the TipRanks database, we discovered that both stocks are rated as ‘Strong Buy’ by the market as a whole, and are even designated as Strong buying chances’. Let’s look more closely:

J.P. Morgan (SRRK, Scholar Rock Holdings)

We’ll start with Scholar Rock, a biopharmaceutical business in the clinical stages that is working to create novel treatments for anemia, cancer, fibrosis, and neuromuscular disorders. Patients with these illnesses experience life-altering impacts, and some of them have few available medical alternatives. The extensive pipeline initiative at Scholar Rock focuses on protein growth regulators in particular disorders.

Apitegromab, an anti-latent myostatin that is currently undergoing clinical trials to treat spinal muscular atrophy, is the company’s top contender. Additionally, the anti-latent TGF-1 medication candidate SRK-181 is being developed for immuno-oncology programs and is currently in the clinical phases. New therapies for fibrosis and anemia in preclinical and exploratory stages are a main emphasis of the company’s pipeline.

Positive findings from the Phase 2 TOPAZ trial, which showed Apitegromab’s effectiveness in people with non-ambulatory spinal muscular atrophy, were just recently made public by Scholar Rock. After 36 months, the results revealed “significant and sustained” improvement in motor function and a favorable safety profile. 90 patients have currently signed up for the TOPAZ experiment.

It is anticipated that 156 patients between the ages of 2 and 12 will be enrolled in Phase 3 REGAIN trial by the end of 3Q23, after the completion of the Phase 2 study and recruitment.

With SRK-181, the early-stage Dragon study is also making headway in its goal of treating patients with advanced cancer who are resistant to checkpoint therapies. Throughout 2H23, additional updates and biomarker information from Scholar Rock’s pipeline program are anticipated.

Tessa Romero, an analyst at J.P. Morgan who covers the stock, believes that Apitegromab has the ability to pay back investors’ money and is a high-quality asset. SRK, in her opinion, presents a “compelling market opportunity… With significant potential for value appreciation at current levels, we like SRK for investors interested in this space,” Romero said of the drug’s potential to enhance existing SMA therapies and improve motor function.

Romero gives SRRK an Overweight (i.e., Buy) recommendation and a $20 price target based on her analysis, representing a staggering 205% upside potential over the course of the following year.

A high purchasing consensus has been reached based on the recent 4 analyst reviews for this stock, 3 of which were Buys and 1 Hold. With an average price objective of $19.50 and a current price of $6.54, the company has a staggering 198% potential gain over the next 12 months.

Keep a look out for these undiscovered jewels. These stocks may be the game-changers you’ve been looking for, according to J.P. Morgan and analysts. Invest wisely!

Allogene Therapeutics (ALLO): Developing Cancer Treatment’s Future of J.P. Morgan claims.

Allogene is a name that stands out with a dash of creativity in the world of ground-breaking biopharmaceutical businesses. As new cancer treatments, Allogene is concentrating on developing AlloCAR T products, specifically AlloCAR T-cell receptors (alloCAR TTM).

These drugs are part of a well-known class that can be used to treat particular tumors; Allogene’s goal is to develop a line of AlloCAR T products that are “off-the-shelf,” allowing physicians to quickly administer carefully planned therapy for their patients.

The most important thing to keep in mind is that Allogene works to hasten the pace and accessibility of cutting-edge anti-cancer therapies, making these exact drugs more reliably accessible to a large number of patients and efficiently meeting demand.

Let’s now discuss the most recent advancements made by Allogene

One of its main competitors, ALLO-501/501A. Phase 2 clinical trials are now being conducted on this anti-CD19 alloCAR T “investigational product” to treat large B-cell lymphoma.

The Regenerative Medicine Advanced Therapy (RMAT) designation for ALLO-501/501A has been granted by the FDA, and the company released several sets of encouraging clinical data in June, demonstrating notable advantages and a tolerable safety profile for all 33 treated patients in the Phase 1 clinical study of ALLO-501/501A. By the end of this year, the business intends to open testing facilities in Australia, Europe, and Canada. Enrollment is anticipated to be completed in Cohort 1H24 of Phase 2.

The investigational research for ALLO-316, Allogene’s first AlloCAR T therapy candidate for solid tumors, is currently moving forward.”Emerging data” from the dose-escalation research have shown the possibility of targeting CD70 in renal cell cancer. By the end of this year, the business intends to have finished Phase 1 testing.

Brian Cheng from JPM has seen the robustness of Allogene’s pipeline and is especially impressed with the 501/501A program. While some investors may not be fans of cell-based approaches, Cheng claims that the 501A program is a commercially viable product with a competitive efficacy/safety profile. We think the current valuation offers a significant potential based on three key Allogene products that target solid tumors, MM, and ALL. He also foresees future strategic shifts in BCMA development and sees a small but distinct economic opportunity for ALLO’s Allogeneic Presentation.

Allogene receives 6 Buy ratings and 2 Hold ratings when the most recent analyst evaluations are considered in their whole, demonstrating a high consensus for a Buy recommendation. The average price prediction for the company is $13.28, which suggests a possible gain of over 184% over the course of the following year from its current trading price of $4.67.

TipRanks is a fantastic platform that compiles all equity insights for people looking for promising stock recommendations for trading.

Disclaimer: This article’s opinions are solely those of the chosen analysts. The information contained herein is purely for educational purposes. Before making any investing selections, conduct your research.

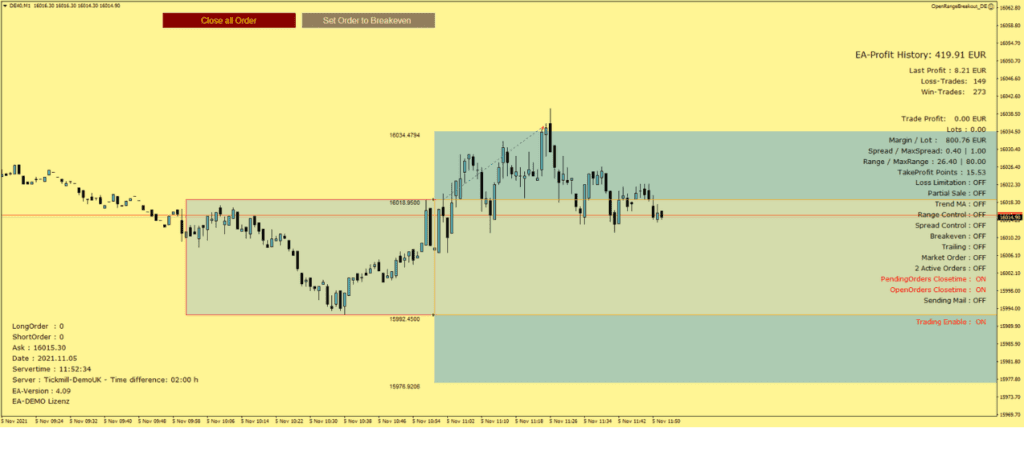

Fully automatic system for breakout trading

The Open Range Breakout Strategy became popular in the 1980s. The book “Day Trading With Short Term Price Patterns and Opening Range Breakout “of the trader Toby Crabel is probably the best known about this strategy.

It is a fairly straightforward approach to trading that is popular with both professionals and beginners. In the pre-market opening phase, one or more stop entries are placed in the market. These will then traded on the market opening breakout.

With the ORB Expert Advisor we have programmed a fully automatic system for DAX CFD trading. This EA uses MetaTrader 4 as a platform. On the website of Youtube are some videos about the EA already published. Automated trading with the MT5 platform will be available shortly.

Volatile Stock Market; $1 Billion Gain for Barbie Doll at the Box Office - Finance News

ALDI's Expansion: Acquiring Winn-Dixie and Harveys Supermark