Despite a recent reduction in inflation, the Federal Reserve (Fed) unexpectedly increased its benchmark interest rate by a quarter percentage point. In light of the uncertainty surrounding the solid economy, this move suggests that there may be another rate increase in the upcoming months. Let’s look at what this implies and how it might impact us.

Table of Contents

The Economy’s Highs and Lows and the Fed’s Rate Hike

The Fed raised the federal funds rate from 5.25% to 5.5%, which is the highest level in 22 years. The action tries to address the ongoing concerns about inflation while balancing economic development.

Fed’s Jest or Rest: Predicting Future Rate Changes?

Speculation about possible rate rises in September or November is sparked by the rate increase. Experts jokingly speculate whether the Fed’s crystal ball of rate forecasts will remain constant or deliver another shock.

Fed Chairman Powell’s Upbeat Outlook,

Jerome Powell, the chairman of the Federal Reserve, recognized the recent slowdown in inflation but remained upbeat about the future of the economy as a whole. The Fed is more confident in progressively reducing inflation because of the improving labor market and steady economy.

How is the US economy doing,? The Story of Growth and Flexibility

The US economy has proven resilient despite inflationary pressures, growing by a respectable 1.8% in the second quarter. A strong economy is characterized by consistent job growth, increased consumer confidence, and sound financial circumstances.

The markets and consumer sentiment,

Financial markets applaud the strong economic backdrop, and the S&P 500 stock index has been rising since March. Spending increases as consumer confidence rises, supporting total economic activity.

The Rate Riddle: Fed Optimism vs. Economic Uncertainty

According to Fed policymakers, the economy’s adaptability will allow it to fight inflation without needing another rate increase to hit the 2% target. As analysts consider the uncertain future, the fun banter about predicting economic outcomes persists.

Wrapping Up – The Fed’s Rate Adventure,

The Fed sets off on an exciting voyage while the economy balances between inflation and growth. The Fed is convinced that it can guide the economy toward stability and prosperity even as uncertainty looms.

Numerous financial indicators today have a significant impact on how we conduct our daily lives. The Consumer Price Index (CPI) is one such significant statistic. The CPI estimates the average change in prices for goods and services over a given time period, according to the Labor Bureau’s definition. Why, therefore, is the CPI so important?

The Main Idea: Paying Attention to Stability

The Federal Reserve, the protector of optimum employment and economic stability, gives its interest rate choices special consideration. It determines if prices are still “stable” or not using the CPI as a guide. As it affects borrowing rates, especially those for vehicle loans, stability is essential.

Understanding the Difference Between Core CPI and CPI

The CPI provides a more realistic picture of long-term trends because it does not include volatile food and energy categories. It aids economists in comprehending how different economic forces affect products and services over time.

Auto Loans and the Ripple Effect

The average interest rate on new auto loans increased to 7.2% in June, exceeding last year’s 5.2% and reaching its highest level in 16 years. Edmunds’ industry statistics show that used car prices rose by 8.3%, totaling an 11% increase. The average monthly payment for a new car reached a record high of $733 on June 30th, breaking the previous record of $678. Surprisingly, 17.1% of purchasers financed their new car with installments of $1,000 or more per month.

Expert Opinions: Excellent News for Auto Buyers

For individuals thinking about buying a new automobile, Jessica Caldwell, Executive Director of Insights at Edmunds, had this positive message: “Automakers are gradually offering more subsidized loan programs as inventories improve and stabilize.”

For consumers with good credit, this should help lessen the effects of rising interest rates, and many may be qualified for shorter loan periods with desired lower interest rates. However, it is advised that all buyers proceed with caution.

A rise in loan rejection rates

The rejection rate for credit applications increased to 21.8% in June, the highest level in the previous five years, according to the most recent Federal Reserve Survey. In particular, rejection rates for secured and unsecured credit card applications, requests for credit limit increases, and credit limit reductions climbed by 21.5%, 30.7%, 13.2%, and 20.8%, respectively. Due to soaring credit card balances, major banks have strengthened their reserves to cover potentially risky consumer loans.

Effect of the Fed on Mortgage Rates

Mortgage rates are not directly determined by the Fed’s actions, although they can be affected by them. Therefore, it is doubtful that the cost of mortgages will alter significantly in the foreseeable future. Mortgage rates are significantly influenced by a number of factors, including housing demand and the forecast for the economy.

Rate decisions by the Fed and the housing market

Due to recent actions by the Central Bank, the Fed’s doubling of interest rates last year had little effect on mortgage rates.

Expert Analysis: The Fed’s Plans

According to Lisa Sturtevant, an economist at Bright MLS, “When the Federal Reserve mostly increases rates each month, the mortgage market has typically already adjusted because it’s very clear what the Federal Reserve intends to do.”

It is crucial to maintain knowledge and use caution while making financial decisions as we travel through these economic waves. Although the dynamic interaction of numerous elements can present difficulties, we can direct our financial voyage towards more straightforward waters with careful planning and skilled advice.

The Effect of the Federal Reserve’s Interest Rate Increase on the Economy: Is a New Recession Coming?

Have you heard about the recent interest rate increase by the Federal Reserve? They are moving, but let’s lighten the situation with a joke first before things get too serious: Why did the economist break up with their calculator? It was unable to commit because it contained too many decimal places.

The Federal Reserve’s Interest Rate Increase Will Change the Game for Investors and Consumers

Think of your favorite roller coaster, but instead of the exhilaration of the ups and downs, the Federal Reserve is raising interest rates, which can make us feel a little uneasy. Roller coaster metaphors become our best friends when customers and investors are concerned about actions! What are interest rates, exactly, and why are they important?

The Potential Effects of Interest Rate Increases on Investors and Consumers

Well then, let’s get down to business! From credit card fees to mortgage rates, interest rates can have an impact on all of us. Similar to your favorite coffee shop boosting prices, the Fed rising interest rates may cause you to reconsider your purchase. But hey, at least we won’t have to put up with Black Friday mall insanity!

The Background of Federal Reserve Rate Increases and Their Controversial Effect

Do you recall the 1970s and 1980s, when interest rates rose along with inflation? The phrase “The Inflationary Frenzy” has the feel of an action film. However, experts disagree on whether the Fed’s rate hikes have always prevented disaster or occasionally fanned the flames.

Potential Impacts on the Stock Market of Future Fed Decisions

Imagine the Fed’s meetings where decisions are made as a dramatic dance of rates, stocks, and anxiety! Will they raise the rates or maintain them? Like a squirrel saving nuts for the winter, the stock market is impatiently awaiting!

Understanding Recessions and Their Importance for Economic Activity

Recessions are those periods when the economy experiences difficulties. Who else believes that economists need a huge glass of water to get rid of their hiccups? Although they can be annoying, they allow us to evaluate how strong our economy is in reality.

Future Prospects and the Healing Power of Laughter

Let’s keep in mind that humor is the best medicine as we say goodbye to this roller coaster trip of interest rates and economic tales. It works for both horrible jokes and economic troubles! So keep this in mind if you’re feeling the pressure of interest rate discussions: Why did the economist fail? Considering that they spent all of their “cents” on hypotheses!

Buckle up, people, and enjoy the ride, whether it’s a stand-up comedy act or an economic roller coaster. Even though the future is unpredictable, laughing will always be a reliable guide through the ups and downs of the economy!

Impact of the Federal Reserve Interest Rate Increase on Investors and Consumers

Federal Reserve Rate Hikes in the Past and Their Controversial Effects on Future Decisions: Effects on the Stock Market and the Future of the Economy

Recognizing Recessions: Their Meaning and Consequences, Rate of Monthly Inflation

The inflation rate began to decline in June 2022, falling to 9.1%, little over half of its peak. The monthly inflation rates in the US since May 2022 are shown below:

May 2022: 8.6%

June 2022: 9.1%

July 2022: 8.5%

May 2022: 8.6%

June 2022: 9.1%

July 2022: 8.5%

August 2022: 8.3%

September 2022: 8.2%

October 2022: 7.7%

November 2022: 7.1%

December 2022: 6.5%

January 2023: 6.4%

February 2023: 6.0%

March 2023: 5.0%

April 2023: 4.9%

May 2023: 4.0%

June 2023: 3.0%

In 2023, how high will interest rates rise?

The Fed’s June forecast for an extra half-percentage point hike in rates was, on average, about a quarter point more than what economists anticipated. Furthermore, the rate increase in March was one-half percent higher than the Fed had anticipated.

The Fed believed it was necessary to keep raising rates because the previous hikes barely affected inflation. But the financial markets anticipate another increase in the benchmark rate in July. However, no additional hikes are anticipated for the remainder of the year since the economy and inflation are anticipated to stabilize.

Will the Fed’s rate increase help savers?

For savers who must contend with rising costs, higher rates may really be good news. After years of near-zero returns on savings, investors may now see an additional 20 to 30 basis points in high-yield online savings accounts as a result of the Fed funds rate’s recent increase, according to Ken Tumin, founder of DepositAccounts.com.

The Current Share Market

The stock market displayed mixed patterns as investors awaited the Fed’s decision in the morning trade. The 10-year Treasury was up 3.86% while the Dow Jones gained just 0.03%. The Nasdaq fell 0.40%, while the S&P 500 fell 0.16%.

Are the Fed Rate Increases Harmful to Borrowers?

The Fed’s fast rate increases have definitely hurt consumers’ wallets. Borrowers will incur an additional $34.4 billion in interest costs over the following 12 months as a result of the 500 basis point rate rise from March 2022 to May 2023, according to WalletHub.

The Fed is anticipated to announce another 25 basis point rise on Wednesday, which would raise expenses for consumers by $1.72 billion. According to WalletHub, this implies that the recent rate hikes by the Fed would have a total yearly cost of $3.6 trillion. The New York Federal Reserve estimates that by the end of March, there was $17.05 trillion in total household debt, with outstanding loans accounting for a bigger proportion.

How Soon Will Inflation Reduce?

Given that, last June’s inflation rate of 9.1% was the highest in forty years and that it has since decreased to 3% this past month, the present period of high inflation may be coming to an end.

In an interview with USA Today, Wisconsin School of Business associate professor Fabio Ghironi stated, “I expect inflation to come back to more normal levels by the end of 2023 and 2024.”

The Fed’s goal inflation rate of 2% is still far above the pace of inflation at now.

How Do Increases in Interest Rates Aid Inflation?

The Fed increased its benchmark interest rate to increase the cost of borrowing for firms and individuals, which will reduce potential spending and sluggish the increase in the price of goods and services.

How often has the Fed raised interest rates?

The Federal Reserve has consistently raised its benchmark federal funds rate since March 2022 by a total of 5 percentage points. The rate increases during this time have been the fastest in forty years. However, it ended that streak in June by maintaining the same main rate.

Can America Escape the Crisis Without a “Soft Landing”?

In the face of persistent inflation, analysts have hoped for a “soft landing,” which would entail a considerable slowdown in either the economy or the unemployment rate without putting a stop to price increases.

Many people projected that it would be difficult for the Fed to control inflation with ten straight rate increases. According to economists, these acts have increased the risk of a slight economic slump in the United States.

Though some banks and investors have grown more optimistic that a “soft landing” may be achievable as a result of low unemployment, ongoing consumer spending, and a slowing of inflation.

The senior U.S. economist at Deutsche Bank, Matthew Luzzetti, said: “At this point, we have more flexibility in our economy, considering the level of the rate increase.”

Do You Think a Recession Is Coming?

No, but other economists think that if the Fed keeps raising interest rates, America may experience a recession.

Since consumers have made large savings during the global health crisis, that has yet to be the case up to this point. An additional $2.5 trillion in savings came from federal stimulus cheques that were meant to benefit struggling families during the epidemic when many Americans were compelled to stay at home and laid-off workers required assistance.

Americans have been able to survive thanks to this financial assistance despite rising interest rates and soaring prices. Spending increased by 3.8% in the first three months of this year, indicating that customers who were forced to stay at home during the epidemic are now in the mood to spend.

However, savings are dwindling, and the pandemic-related surplus still stands at approximately $1.5 trillion, according to Moody’s Analytics.

United States Inflation Rate

Consumer prices rose 3% in June compared to the same month last year. It was less than the 4% increase from the previous month, per the Consumer Price Index published by the Labor Department.

The impact of stabilizing gasoline prices has reduced some pressures that are still gradually creeping back up, such as rising gas costs and steadily rising rents, making June the twelve consecutive months that inflation has been declining.

Overall, costs are still generally on the high side. For instance, as the pandemic-related supply chain disruptions have subsided, old cars have become more affordable. However, as firms provide high wages to retain workers in the face of a protracted labor shortage, prices for services like haircuts and auto repairs have continued to grow.

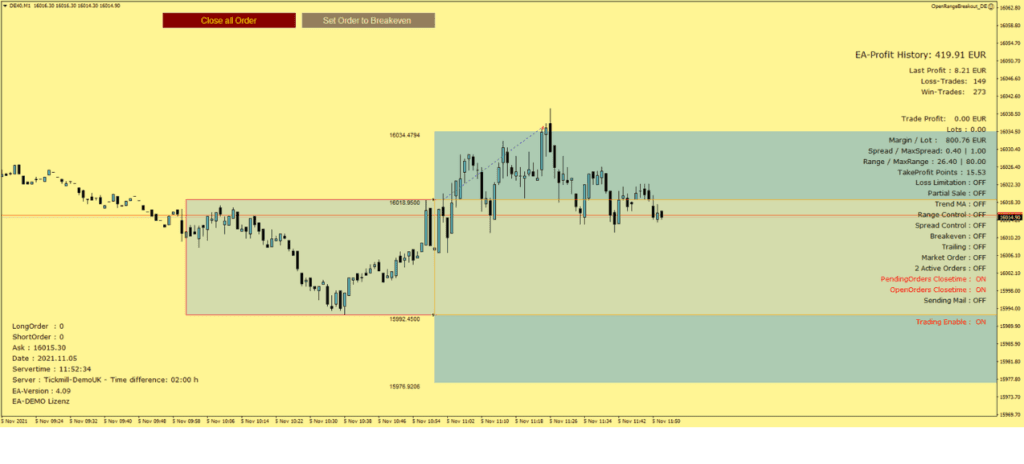

Fully automatic system for breakout trading

The Open Range Breakout Strategy became popular in the 1980s. The book “Day Trading With Short Term Price Patterns and Opening Range Breakout “of the trader Toby Crabel is probably the best known about this strategy.

It is a fairly straightforward approach to trading that is popular with both professionals and beginners. In the pre-market opening phase, one or more stop entries are placed in the market. These will then traded on the market opening breakout.

With the ORB Expert Advisor we have programmed a fully automatic system for DAX CFD trading. This EA uses MetaTrader 4 as a platform. On the website of Youtube are some videos about the EA already published. Automated trading with the MT5 platform will be available shortly.

The Ganja Guru

J.P. Morgan claims that these two under-$10 stocks might double your investment in "Hidden Gems." - Finance News

Стильные советы по подбору крутых луков на каждый день.

Мнения стилистов, события, все новые коллекции и шоу.

https://www.addonface.com/read-blog/83288