Unveiling the Hidden Challenges of Personal Loans: What Every Borrower Should Know

In the dynamic financial landscape of 2023, personal loans have surged in popularity, with U.S. balances soaring to an impressive $241 billion during the third quarter, marking a substantial 15% increase from the previous year, as reported by TransUnion. The allure of personal loans lies in their perceived flexibility and accessibility. However, beneath the surface, there are crucial aspects every borrower should be cognizant of before venturing into this financial territory.

1. The Deceptive Allure of Flexibility

Proceeds for Anything, But at What Cost?

Unlike mortgage or auto loans, personal loans offer unparalleled flexibility, allowing borrowers to utilize the funds for various purposes such as home improvements, travel, or even starting a business. While this versatility may seem appealing, it comes with a caveat: the absence of restrictions might lead to impulsive decisions.

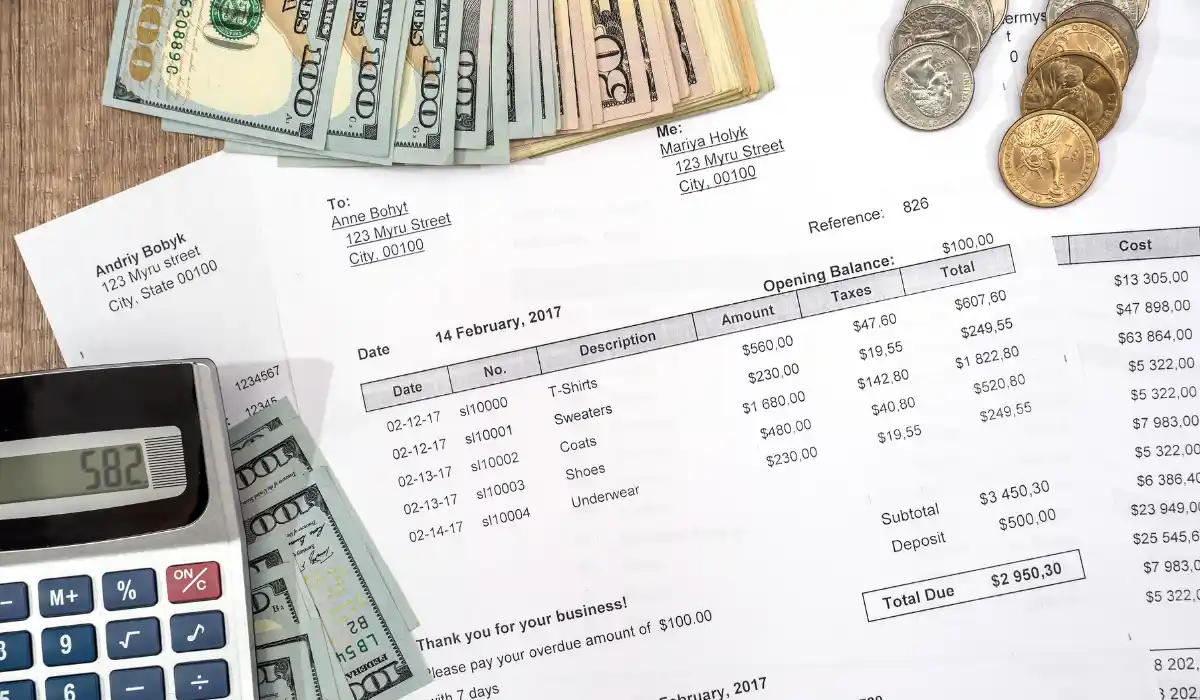

The danger lies in the temptation to acquire a personal loan for frivolous reasons, such as upgrading electronics or enhancing one’s wardrobe. In reality, taking on debt is a significant commitment, and the repercussions of falling behind on personal loan payments can be severe. To navigate these waters wisely, borrowers should reserve personal loans for substantial and essential expenses, like creating additional living space or investing in career development.

2. The Price of Poor Credit: Uncompetitive Rates

Navigating the Waters of Unsecured Loans

Personal loans, being unsecured, do not require specific collateral, exposing lenders to a higher level of risk. Consequently, these lenders heavily rely on credit scores to evaluate loan applications. While obtaining a personal loan with a less-than-ideal credit score is possible, the trade-off often comes in the form of higher borrowing rates.

For borrowers with poor credit, the interest rates offered may not be as competitive, making the loan less affordable than anticipated. It’s imperative for individuals in this situation to weigh the potential financial strain against the immediate need for funds and explore alternative options.

3. Hidden Fees: The Silent Culprit

Beyond the Loan Amount: Understanding Fees

When entering into a personal loan agreement, borrowers may encounter various fees, such as origination fees, that can significantly impact the overall cost. While it’s not uncommon for other loan types to have associated fees, personal loan borrowers need to pay careful attention to the fine print.

Some lenders allow borrowers to roll these fees into the loan itself, providing a seemingly convenient solution. However, this approach may inadvertently lead to complacency regarding fees. To avoid this pitfall, borrowers must meticulously review the terms, compare fee structures across different lenders, and be aware of any exorbitant charges.

Navigating the Personal Loan Landscape: A Prudent Approach

In certain scenarios, turning to a personal loan can make financial sense. However, before committing to this borrowing avenue, it is crucial to understand and navigate the potential pitfalls involved. By exercising prudence and considering the long-term implications, borrowers can make informed decisions that align with their financial goals.

Our Recommendations for the Best Personal Loans

Our team of independent financial experts has meticulously scrutinized various personal loan offerings to identify those with competitive rates and minimal fees. To assist you in making an informed decision, we present our carefully curated picks for the best personal loans in the market.

Disclaimer: Editorial Independence

We firmly adhere to the Golden Rule, and our editorial opinions are exclusively ours. They have not been subjected to prior review, approval, or endorsement by any featured advertisers. It’s essential to note that The Ascent does not cover all available offers on the market. Our editorial content is distinct from The Motley Fool’s, created by a different analyst team. For transparency, The Motley Fool maintains a disclosure policy.