The Ultimate Guide to Choosing the Best Personal Loan Provider

In the vast landscape of personal loan providers, finding the right one can be a daunting task. With interest rates fluctuating and terms varying, it’s crucial to make an informed decision. Our comprehensive guide explores the top-ranking personal loan providers based on recommendations from industry experts.

Unveiling the Cream of the Crop

We’ve meticulously analyzed 11 trusted financial sites, including The Ascent/Motley Fool, Bankrate, Business Insider, CNBC Select, CNET, Forbes Advisor, Investopedia, LendingTree, NerdWallet, WalletHub, and Time Stamped. Our monthly updated ranking ensures you get the most-recommended providers with the best APR, terms, and loan amounts.

How We Choose Personal Loan Providers

Our methodology is simple yet effective. Each month, we scour the internet for personal loan provider recommendations from reputable industry experts. The more a financial institution appears on these experts’ lists, the higher it scores in our ranking. It’s a streamlined approach to ensure you get the best of the best.

Personal Loans Demystified

What is a Personal Loan?

Personal loans, offered by banks, credit unions, or online lenders, are unsecured loans for various expenses. Your creditworthiness and ability to repay determine the loan terms.

What Can Personal Loans Be Used For?

From home improvements to medical bills and debt consolidation, personal loans offer versatility. Some lenders may impose usage restrictions, so it’s crucial to check the terms.

Am I Eligible for a Personal Loan?

Eligibility criteria vary among financial institutions. Review your credit score, credit history, and ensure the lender’s terms align with your income level.

How to Apply for a Personal Loan

- Determine Your Needs: Know the amount and purpose.

- Check Your Credit: A higher score means a better loan.

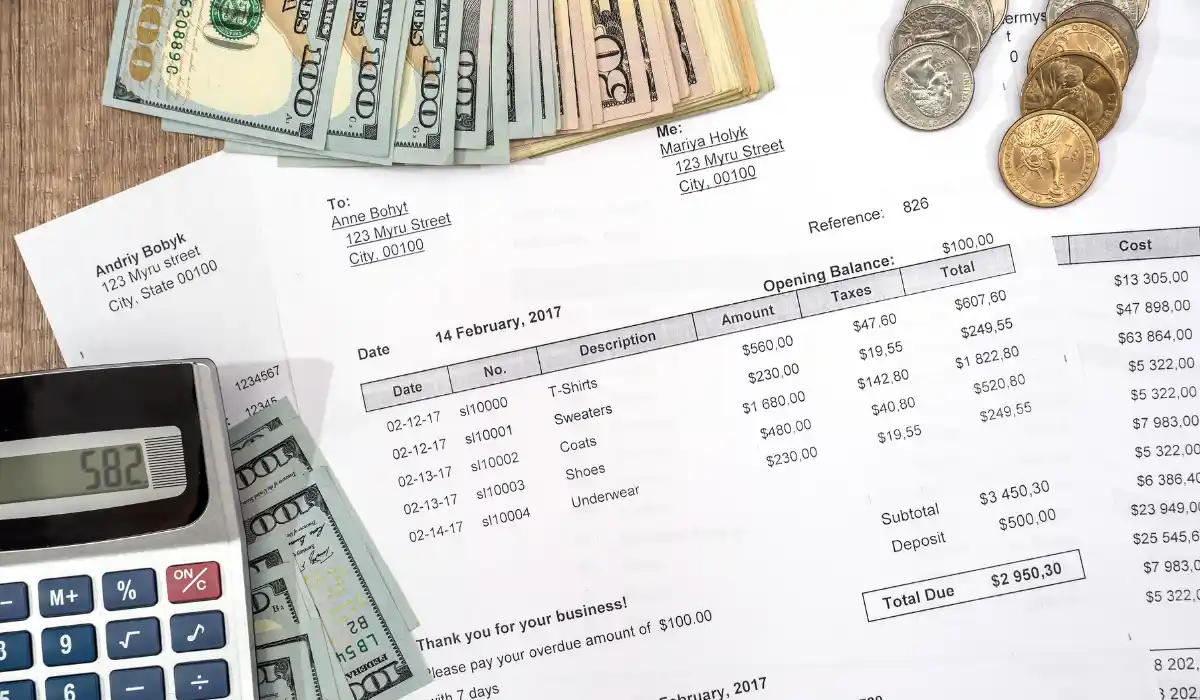

- Gather Documents: Bank statements, ID, pay stubs, and tax returns.

- Submit Online Application: Be prepared for a credit check.

Can I Prequalify for a Personal Loan?

Most lenders allow prequalification without affecting your credit score. Understand the types of credit checks: soft checks for preapproval and hard checks for detailed analysis.

Required Documents for Personal Loan Application

Prepare bank statements, personal identification (driver’s license or passport), and proof of income (pay stubs, tax returns).

How Long Does It Take to Receive a Credit Score?

Building credit takes time. For those starting, it can range from two to six months of credit activity.

What Is Considered a Good Credit Score?

Credit scores range from bad to excellent. FICO scores, the most common, categorize them as follows:

- Poor: 300-629

- Fair: 630-689

- Good: 690-719

- Excellent: 720-850

Repayment Concerns

If unable to repay, the balance can go from delinquency to default, leading to collections. Unpaid loans impact credit scores after 30 days. Communicate with your lender to explore options like hardship programs or refinancing.

In Conclusion

Choosing a personal loan provider requires careful consideration. Our ranking system, based on expert recommendations, aims to simplify this process. Whether you seek a loan for home improvements, medical expenses, or debt consolidation, our guide ensures you make an informed decision. Explore the top providers and secure a loan with favorable terms today.